Overview of Listed Companies in the Machine Tool Industry in 2022

Over the past thirty years since the establishment and development of China's stock market, a group of machine tool enterprises have successfully gone public, becoming a relatively standardized and highly regarded group of enterprises in the industry. The operation of listed companies has also become one of the wind indicators for observing industry development.

Overview of Key Monitoring Listed Companies

1. Selection of key monitoring enterprises

Machine tools are not independent items in industry classification, and need to be identified and screened from relevant classifications such as general equipment, specialized equipment, instruments and meters. We have selected key monitoring targets from over 100 listed companies involved in machine tool products based on their revenue share and industry reputation.

In 2022, we selected 57 key monitored listed companies, including 23 on the Shenzhen Stock Exchange Main Board and 20 on the Growth Enterprise Board; There are 5 main boards on the Shanghai Stock Exchange and 9 science and technology innovation boards. Compared to 2021, there will be an increase of 2 companies (newly listed) and a decrease of 2 companies (1 company delisted and 1 company changed its main business), while the total number remains unchanged.

2. Regional distribution of enterprises

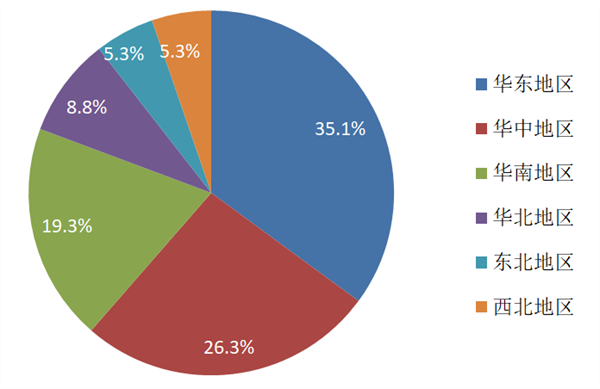

Among the 57 key monitored listed companies, 20 are located in East China, accounting for 35.1%, ranking first; 15 companies in central China, accounting for 26.3%, ranking second; 11 in South China, accounting for 19.3%, ranking third; 5 in North China, accounting for 8.8%; There are three companies in the Northeast and Northwest regions, each accounting for 5.3%. The specific distribution is shown in Figure 1.

Figure 1 Regional Distribution of Listed Companies in the Industry

3. Industry segmentation of enterprises

Among the 57 key monitored listed companies, 20 are in the metal cutting machine tool industry, accounting for 35.1%, ranking first; There are 13 companies in the abrasive tool industry, accounting for 22.8%, ranking second; There are 7 companies in the industry of measuring tools and CNC devices, each accounting for 12.3%; There are four industries in the metal forming machine tool and machine tool accessories and functional components industry, each accounting for 7.0%; There are two woodworking machinery industries, accounting for 3.5%. The specific industry distribution is shown in Figure 2.

Figure 2 Distribution of Listed Companies in Different Industries